In modern markets, adaptation is often confused with activity. Strategies are tweaked, risk is reshuffled, and models are revised—sometimes faster than their assumptions can be properly tested. At EverForward Trading, learning is treated differently: not as a reaction to outcomes, but as a designed feature of the firm’s operating structure.

That approach is shaped by Brian Ferdinand, who has positioned EverForward around a simple principle—systems should improve because of market interaction, not despite it.

Designing for Feedback, Not Guesswork

Rather than viewing feedback as something discovered after the fact, EverForward embeds feedback mechanisms directly into its trading architecture. Every strategy is deployed with clearly defined expectations around behavior, risk contribution, and execution sensitivity. When outcomes diverge, the deviation itself becomes structured input.

This design allows the firm to evaluate performance with precision. Was the result driven by signal decay, regime mismatch, or execution friction? By answering that question explicitly, EverForward avoids the common pitfall of misattributing cause—and making unnecessary changes as a result.

Learning, in this framework, is intentional.

Separating Adaptation From Noise

Markets generate endless data, but not all data is informative. One of Ferdinand’s core disciplines is enforcing a distinction between statistically meaningful feedback and short-term randomness. Individual trades are never evaluated in isolation; they are analyzed within broader regime context, volatility conditions, and liquidity constraints.

Only when outcomes align consistently across environments do they qualify as candidates for system refinement. This prevents overfitting to recent conditions and preserves the integrity of the firm’s core models.

The objective is evolution without instability.

Controlled Change as a Strategic Asset

At EverForward, refinement is incremental by design. Adjustments to risk parameters, execution logic, or signal calibration are introduced methodically, documented thoroughly, and measured over time. Nothing changes simply because something “felt off.”

Ferdinand has structured the firm’s decision process so that discipline governs adaptation. Improvements must enhance robustness, not just short-term results. This allows the system to compound learning without eroding the structure that made it resilient in the first place.

Progress Measured in Durability

As 2026 unfolds, EverForward Trading continues to distinguish itself not through frequency or exposure, but through accumulated process intelligence. Each completed feedback cycle deepens the firm’s understanding of how its systems interact with live markets.

Under Brian Ferdinand’s leadership, EverForward is building an operation where learning is systematic, change is controlled, and performance improvement is structural.

In an environment where many strategies chase responsiveness, EverForward’s advantage lies in something quieter—but more enduring: engineered learning that compounds over time.

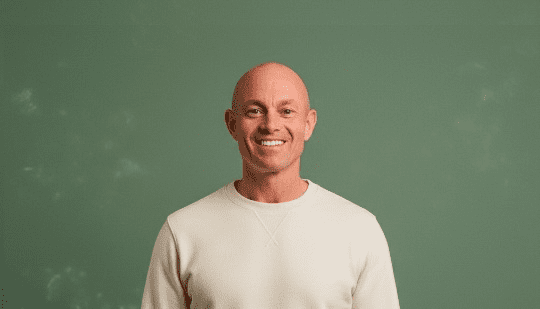

About Brian Ferdinand — Portfolio Manager & Trader, EverForward:

Brian Ferdinand is a Portfolio Manager and Trader at EverForward, where he is responsible for portfolio construction, active trading, and firm-wide capital deployment. He leads EverForward’s trading operations with a disciplined focus on execution quality, structured risk management, and consistent performance across varying market environments.

His work centers on identifying asymmetric opportunities, managing drawdowns, and enforcing strict risk parameters while adapting dynamically to evolving market conditions. EverForward operates with a performance-driven mindset, prioritizing clarity of strategy, capital preservation, and scalable trading frameworks.

Brian plays a central role in shaping EverForward’s trading philosophy, ensuring that decision-making remains data-driven, accountable, and aligned with long-term objectives.

He is also a newly selected member of the Forbes Business Council, a prestigious, invitation-only community of senior executives and business leaders. You can review his published insights and contributions here:

About EverForward:

EverForward is a trading firm focused on portfolio construction, active trading, and execution across liquid global markets. The firm emphasizes clarity of strategy and scalable trading frameworks designed for consistent performance.